Daphne Wilson – Mortgage Note Investing – Second Mortgages

$2,996.00 Original price was: $2,996.00.$166.00Current price is: $166.00.

Instant Download: You will receive a download link via your order email immediately

Should you have any questions, please contact us: [email protected]

Daphne Wilson – Mortgage Note Investing – Second Mortgages

Daphne Wilson – Mortgage Note Investing – Second Mortgages

COURSE DESCRIPTION:

Mortgage Note Investing: DISTRESSED SECOND MORTGAGES

PURCHASE YOUR FIRST ASSET WITHIN 90 DAYS AND INCREASE YOUR NET WORTH. After taking this course, you’ll be able to purchase mortgages notes independently and be ready to begin making money in this lucrative industry within 90 days after completing this workshop.

Comprehensive, on-demand and online workshop with step-by-step instructions, sample documents and templates, quizzes to test your understanding of the content, interactive format with other students and mentorship available to assist you with your first few deals. This workshop goes into detail on EXACTLY how I invest in second mortgages. You’ll review actual notes available for sale on the open market and have a list of OVER 20 RESOURCES from which to purchase notes PLUS more ways to increase your deal-flow.

By the end of the workshop you’ll be able to:

1. Source, research and purchase mortgage notes independently.

2. Identify the risk of your mortgage notes investments

3. Understand various exit strategies and business models

4. Learn my proven method for investing in notes that allowed me to quickly and easily grow my portfolio

Topics covered in the workshop includes:

- Creating an investment company & building the infrastructure

- The major components of note buying

- Business models to consider

- Where to locate mortgage notes available for sale

- How I choose which mortgage note(s) to purchase

- Various ways to make money with mortgage notes

- Resources available to you and how and when to engage them

- Key rules & regulations of note investing

- Risk Management strategies that I use

- Identifying and reviewing key documents

- How to research a note before you buy

- Actual walk-thru of purchasing a mortgage note

- Communicating with the borrower/homeowner

- Loan Modifications and workouts

- How to evaluate exit strategies

- How investors acquire properties at below wholesale by purchasing mortgage notes

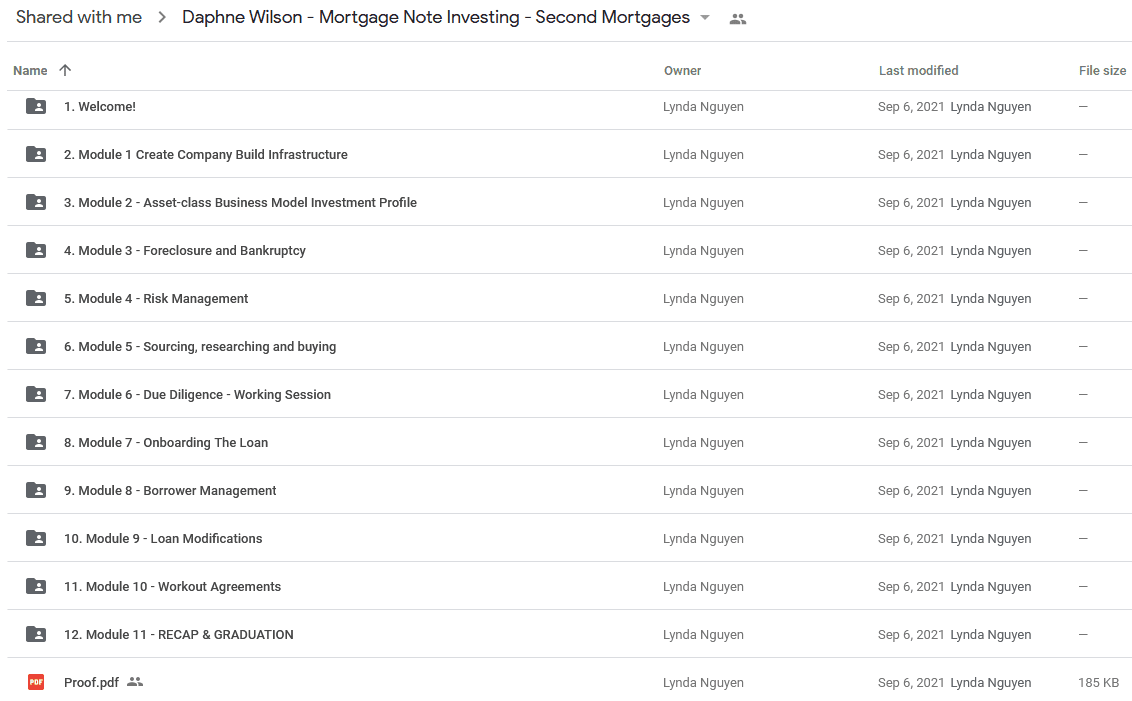

Course Curriculum

Welcome!

StartOrientation (20:03)

Module 1: Create Company Build Infrastructure

StartCreate your company & Build the infrastructure (69:02)

Module 2 – Asset-class Business Model Investment Profile

StartUnderstand the asset-class and decide on an investment profile (42:38)

Module 3 – Foreclosure and Bankruptcy

StartUnderstanding how bankruptcy and foreclosure affect note investors (38:49)

StartThe Power Team (30:29)

Module 4 – Risk Management

StartEffectively Manage Risk Before and After Buying a Note (74:34)

Module 5 – Sourcing, researching and buying

StartFinding and researching notes (93:21)

StartDetermining the price of a note (31:54)

Module 6 – Due Diligence – Working Session

StartWorking Session #1 on due diligence (36:39)

StartWorking session #2 on due diligence (37:48)

Module 7 – Onboarding The Loan

StartLoan management (42:01)

Module 8 – Borrower Management

StartHow to manage your borrower (59:22)

StartFair Debt Collection Practices Act (FDCPA)

StartMiranda warnings

Module 9 – Loan Modifications

StartModifications and Temporary Adjustments (30:02)

Module 10 – Workout Agreements

StartWorking out your loans (56:00)

Module 11 – RECAP & GRADUATION

StartNext Steps (14:29)

Proof Content

Delivery Method

– After your purchase, you’ll see a View your orders link which goes to the Downloads page. Here, you can download all the files associated with your order.

– Downloads are available once your payment is confirmed, we’ll also send you a download notification email separate from any transaction notification emails you receive from IMC.sale.

– Since it is a digital copy, our suggestion is to download and save it to your hard drive. In case the link is broken for any reason, please contact us and we will resend the new download link.

– If you cannot find the download link, please don’t worry about that. We will update and notify you as soon as possible at 8:00 AM – 8:00 PM (UTC+8).

Thank You For Shopping With Us!

9 reviews for Daphne Wilson – Mortgage Note Investing – Second Mortgages

There are no reviews yet.